A Taiwanese man was apprehended on Wednesday for suspected credit card fraud at Far East Plaza in Singapore. The 26-year-old individual was taken into custody after engaging in a dubious credit card transaction at a mobile phone store within the mall. The arrest was made possible with the cooperation of the store owner and security personnel on-site.

According to a statement released by the police on Thursday, initial investigations indicated that the man had recently arrived in Singapore and was allegedly operating on behalf of an international criminal organization. It was discovered that he had utilized contactless payment methods, such as near field communication (NFC) mobile payments, utilizing stolen credit card information to conduct illicit transactions across multiple establishments in the country.

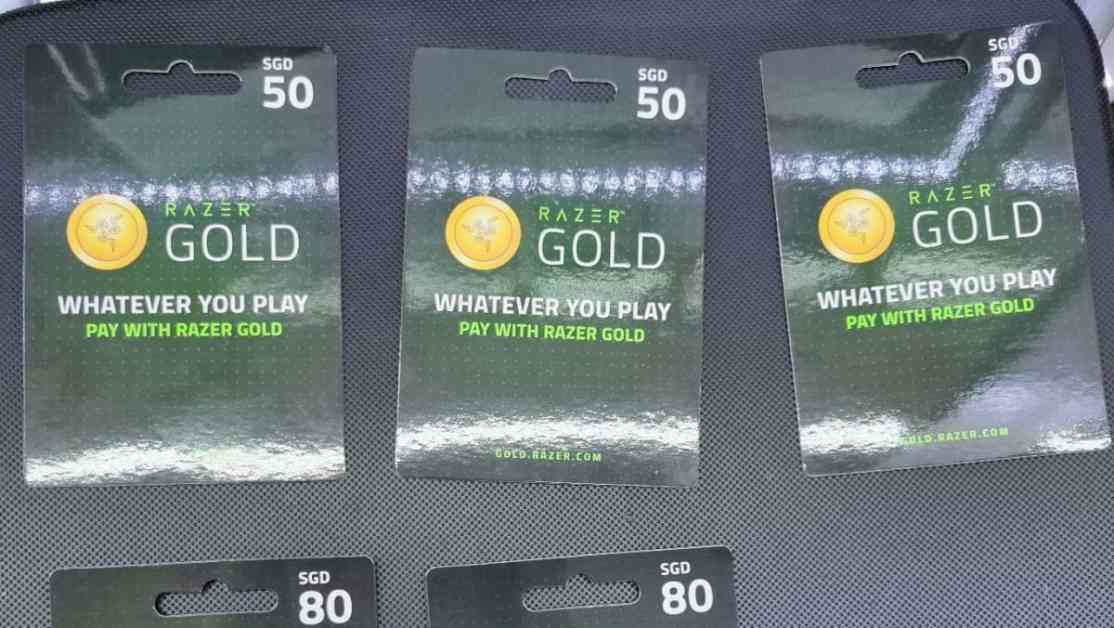

The authorities revealed that the fraudulent activity had impacted several businesses, with the individual successfully purchasing Razer Gold eGift cards totaling S$1,110 from various 7-11 outlets before being apprehended. Razer Gold, a virtual currency offered by gaming company Razer, allows users to make in-game purchases and acquire credit on gaming platforms. Along with the gift cards, three mobile phones were also confiscated during the arrest.

The suspect is set to appear in court on Friday, where he will face charges of cheating. If convicted, he could potentially receive a sentence of up to 10 years of imprisonment along with a fine. Emphasizing the severity of the crime, the police issued a warning regarding the unauthorized use of credit or debit cards, stressing that they will take decisive action against individuals involved in fraudulent activities.

In light of this incident, law enforcement authorities urged the public to act promptly in the event of a lost or stolen credit or debit card to prevent unauthorized usage and potential financial losses. It serves as a cautionary reminder for individuals to safeguard their financial information and report any suspicious transactions promptly.

Expert Insights on Credit Card Fraud

To gain a deeper understanding of the implications of credit card fraud and the measures in place to combat such criminal activities, we sought the expertise of cybersecurity specialist Dr. Jane Lee. Dr. Lee emphasized the importance of vigilance when it comes to protecting personal financial data in today’s digital age.

“Credit card fraud remains a prevalent issue in our society, with criminals constantly devising new tactics to exploit vulnerabilities in payment systems. It is crucial for consumers to adopt secure practices, such as regularly monitoring their financial statements, setting up transaction alerts, and safeguarding their card details from unauthorized access,” Dr. Lee advised.

She further highlighted the significance of collaboration between law enforcement agencies, financial institutions, and technology companies in combating fraudulent activities. By enhancing cybersecurity measures, raising public awareness, and implementing stringent regulations, stakeholders can collectively mitigate the risks associated with credit card fraud and safeguard the interests of consumers.

Protecting Your Financial Assets

In today’s interconnected world, where digital transactions have become the norm, it is essential for individuals to prioritize the security of their financial assets. By adhering to best practices such as using secure payment methods, regularly updating passwords, and promptly reporting any suspicious activities to financial institutions, consumers can reduce their vulnerability to fraudulent schemes.

Remember, safeguarding your personal information is paramount in preventing unauthorized access and potential financial losses. Stay informed, stay vigilant, and take proactive steps to protect your financial well-being in an increasingly digital landscape. By prioritizing security and remaining alert to potential threats, you can minimize the risks associated with credit card fraud and ensure a safe and secure financial environment for yourself and others.

Protecting your financial assets is not just a matter of convenience—it’s a crucial step in safeguarding your financial well-being and maintaining peace of mind in an ever-evolving digital landscape. By taking proactive measures to enhance security and staying informed about the latest cybersecurity trends, you can protect yourself from potential threats and ensure a secure financial future. Remember, your financial safety is in your hands—empower yourself with knowledge and vigilance to safeguard your assets and prevent falling victim to fraudulent activities.